To explore the topic of the Greek Debt Crisis, you need to do a thorough research study and analyze numerous interconnected factors, including the political, economic, and social dimensions. You aim to simplify complex concepts and present them in a non-confusing way for the readers. At the same time, you don’t need to oversimplify the issue. If you are unsure how to write an essay on this topic or need tips on how to structure an essay logically, let our experts assist you. They are here to help you with all kinds of writing assignments, whether it’s a diagnostic essay or a compare and contrast essay. Also, they will be glad to help you if you are struggling to find reliable sources of information to ensure the accuracy of the data. They have access to many online and offline resources and know where to find up-to-date information. You can be sure of getting original content on the given topic because our experts start working on your essay from scratch. They check it for plagiarism and use a trustworthy AI writing checker to make sure the content they deliver is free from AI-generated content. Here’s a sample that will give you an idea of what to expect from our experts.

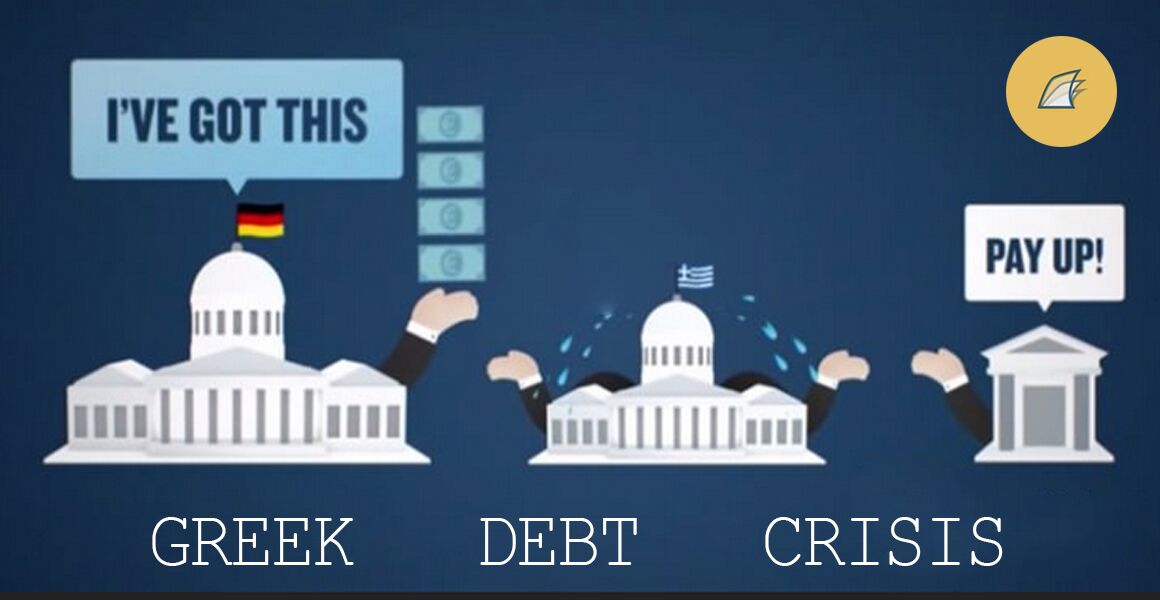

A debt crisis occurs when a country is unable to pay back or refinance its government debt without any external help. The Greek debt crisis started in 2009 when the government announced that it had previously misreported the data on public debt and deficit levels (Alderman et al.). This event harshly and negatively affected Greece’s ability to borrow from the markets since mistrust of financial creditors led to very high borrowing rates for the country (Higgins and Klitgaard). Therefore, Greece was forced to ask for help from international organizations such as the International Monetary Fund and the EU agencies.

A few significant causes of the Greek debt crisis could be identified. One of them is a substantial structural deficit, which means that the government spends more money on consumption than it receives from different revenue sources (e.g., tax collections) (Higgins and Klitgaard). The accumulated government deficit represents government debt since the country’s government has to borrow from various sources to finance current spending. Greece was borrowing significant amounts of money during the 2000s due to the mentioned reason. The financial crisis of 2007-2008 significantly affected shipping and tourism which were very important for the Greek economy. Therefore, the ability of Greece to finance its consumption without resorting to borrowing was rather limited.

Moreover, the problems with statistical credibility have aggravated the situation. The process of budget planning was complicated due to the fact that reported numbers for GDP growth, public deficit, and debt were quite different from real figures. Thus, recognition of this discrepancy in statistical data by the Greek government led to unfortunate consequences for the country. Finally, corruption, as well as tax evasion, are very problematic in Greece (Greek Ministry of Finance). The country is in need of tax collections to repay loans and finance consumption. However, the government is not able to collect all the revenues that are supposed to be collected due to corrupted public agents and persistent tax evasion which is caused by low social trust.

In conclusion, the Greek debt crisis is now one of the most problematic issues of the EU. Greece continues to borrow from international organizations such as the IMF since it is not able to borrow from the markets anymore.

The International Monetary Fund forces the Greek government to implement structural reforms and impose harsh austerity terms to ensure loan repayments, which leads to public dissatisfaction by the government and even greater tax evasion. Greece missed a loan repayment to the IMF for the first time on June 30, 2015. The Greek debt crisis is a current phenomenon that should be analyzed in the dynamics of the upcoming events.

Works Cited

Alderman, Liz, et al. “Greece’s Debt Crisis Explained.” The New York Times, 17 June 2016, www.nytimes.com/interactive/2015/business/international/greece-debt-crisis-euro.html.

Greek Ministry of Finance. “Update of the Hellenic Stability and Growth Programme Including an Updated Reform Programme.” January, 2010, www.ec.europa.eu/economy_finance/economic_governance/sgp/pdf/20_scps/2009-10/01_programme/el_2010-01-15_sp_en.pdf.

Higgins, Matthew, and Thomas Klitgaard. “Saving Imbalances and the Euro Area Sovereign Debt Crisis.” Current Issues in Economics and Finance, vol. 17, no. 5, 2011, pp. 1–11.