Key findings:

U.S. back-to-school spending is projected to total $30.9B in 2025, down slightly from $31.3B in 2024, signaling more cautious consumer behavior.

Average household spending reaches $886 per family, with electronics ($311) and clothing ($260) remaining the biggest budget items.

Parents now spend 7.3% more on school supplies, with prices for index cards (+42.6%) and notebooks (+17.1%) driving the steepest increases.

The average weekly cost of school meals rose 5.4%, pushing annual food expenses to $3,198 per child, a record high.

Low-income families (<$50K) increased their per-child spending by 10%, while high-income households cut back by nearly 9%, narrowing the spending gap.

68% of parents cite higher prices, and 60% worry about the economy, making inflation the key driver of reduced discretionary spending.

Despite tighter budgets, total costs per child remain high, showing families continue prioritizing essential items over optional purchases.

As the 2025 school year approaches, U.S. families are entering the back-to-school season with tighter budgets and shifting spending priorities. After several years of inflation-driven price increases, total national spending is expected to ease slightly to $30.9 billion, reflecting a more cautious approach to school shopping. While costs for electronics, clothing, and meals remain elevated, parents are focusing on essential items and value-driven choices. This analysis examines how inflation, income levels, and changing consumer behavior are reshaping back-to-school spending trends across the United States.

How much do American families plan to spend on back-to-school shopping?

Back-to-school spending trends: 2021-2025

The chart below illustrates the expected back-to-school spending per child from 2021 to 2025. These figures highlight how parents’ financial expectations for school-related expenses have shifted amid inflation, economic uncertainty, and changing shopping behaviors.

- In 2021, parents expected to spend $612 per child, marking the start of a brief upward trend.

- The highest expected spending occurred in 2022 at $661, before dropping steadily in the following years.

- By 2025, average spending is projected to fall to $570, the lowest level in five years.

How expected back-to-school spending per child has changed over time

The data reveal a gradual decline in expected back-to-school spending after a post-pandemic peak in 2022. Data indicate that families are cutting back on discretionary school purchases as prices stabilize and digital learning reduces the need for traditional supplies. Overall, the trend suggests a shift toward more cautious and needs-based spending as households adapt to ongoing economic pressures.

While overall spending trends show a decline, household income continues to play a major role in shaping how much families expect to spend on back-to-school shopping.

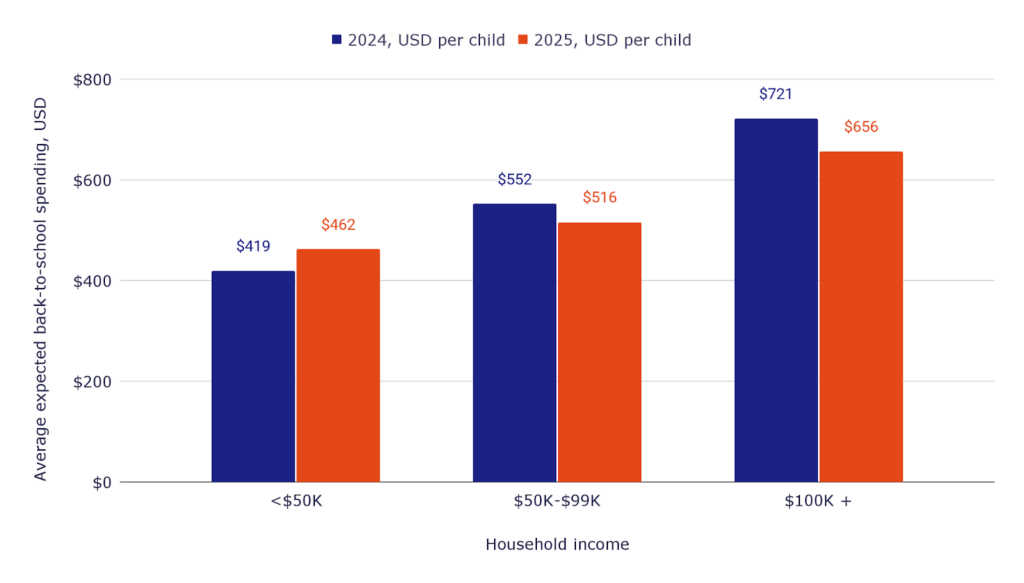

Back-to-school spending by household income level

The chart below compares expected back-to-school spending per child by household income level in 2024 and 2025. It highlights the consistent spending gap between higher- and lower-income households, showing how income disparities influence parents’ school-related budgets.

- Families earning under $50K plan to spend $462 per child in 2025, up from $419 in 2024.

- Middle-income households ($50K-$99K) expect a modest drop, from $552 in 2024 to $516 in 2025.

- High-income families ($100K+) remain the biggest spenders, though their expected amount declines from $721 to $656 year over year.

How income influences expected back-to-school spending in 2024-2025

The data suggest that income-driven spending gaps persist, but high-income households are tightening their budgets slightly. Lower-income families, however, show a small increase in planned spending, possibly reflecting a rebound in consumer confidence or greater emphasis on essential school supplies. Overall, the narrowing differences between income groups indicate a cautious approach to back-to-school shopping in 2025.

Following the income-based spending patterns, it’s important to understand why many households plan to cut back on their back-to-school expenses this year.

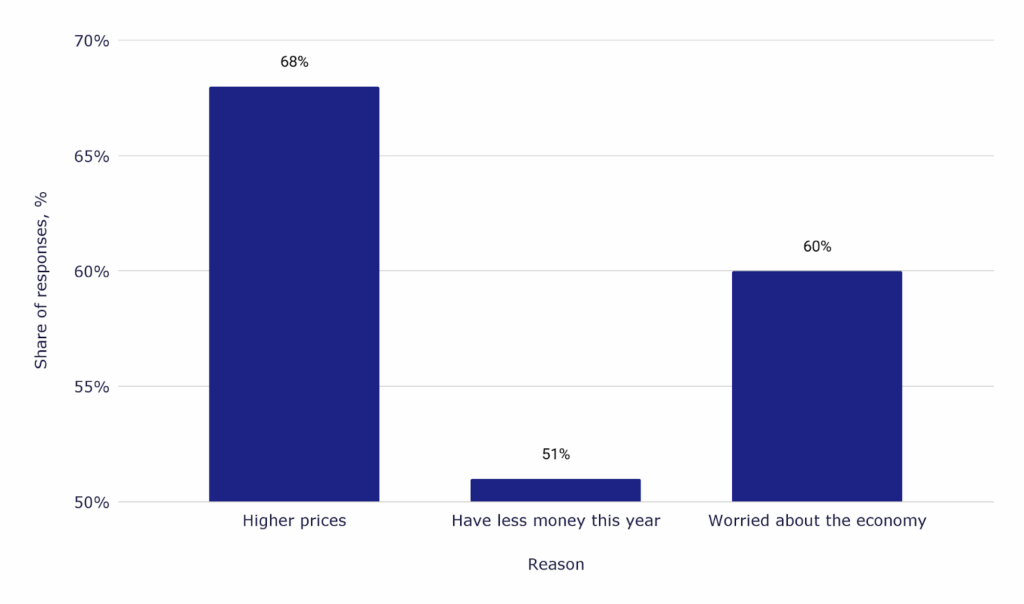

Why families expect to spend less on back-to-school shopping

The chart below outlines the main reasons why families expect to spend less on back-to-school shopping. These insights reveal that economic pressures and financial uncertainty are the primary drivers behind reduced spending intentions.

- 68% of respondents say higher prices are the main reason for reducing their back-to-school budgets.

- 60% are worried about the economy, reflecting ongoing concerns about inflation and job security.

- 51% of households simply have less money this year, indicating tighter family budgets.

Key reasons behind reduced back-to-school spending in 2025

The data indicate that inflation and economic uncertainty continue to weigh heavily on household spending decisions. Even as some costs stabilize, families remain cautious, prioritizing essentials and limiting discretionary purchases. This sentiment underscores a broader trend of financial restraint as consumers adapt to a still-uneven economic recovery.

After understanding the reasons behind reduced overall spending, it’s helpful to break down how much parents expect to spend across specific back-to-school categories.

How much does the average U.S. household spend on back-to-school shopping?

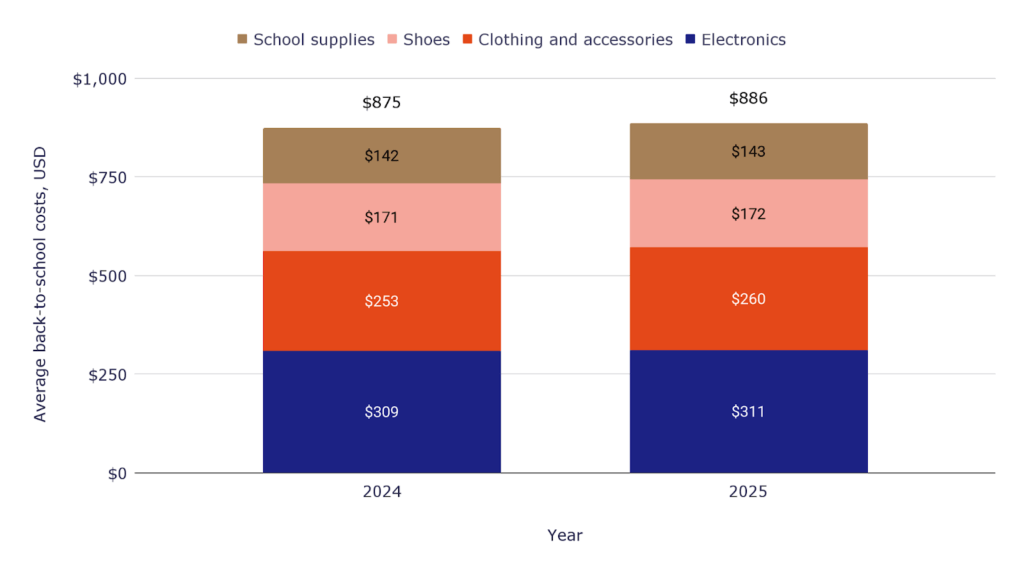

Average back-to-school costs by category in 2024-2025

The chart below highlights the average back-to-school spending by category in 2024 and 2025. It shows how families allocate their budgets across essentials such as electronics, clothing, shoes, and school supplies, revealing which items take up the largest share of total expenses.

What is the average cost of school electronics per child?

- The average cost of electronics remains the highest, slightly rising from $309 to $311 per child.

What is the average cost of school clothes per child?

- Clothing and accessories follow with an increase from $253 to $260, showing steady demand despite tighter budgets.

What is the average cost of school supplies per student?

- Spending on school supplies grows marginally from $142 to $143, while total average back-to-school spending reaches $886 in 2025.

How much do families spend on back-to-school shopping by category?

How much does it cost to go back to school?

- In 2025, the average spend per family on back-to-school in the U.S. is $886.

Back-to-school shopping costs continue to edge upward across nearly all categories, suggesting that inflation and product prices are keeping total expenses high even as families try to cut back. Electronics and clothing remain the biggest budget items, reflecting both classroom needs and personal expression among students. Overall, the average back-to-school spending trend indicates stable demand and cautious consumer behavior going into the 2025 school year.

While individual budgets show how much parents plan to spend per child, looking at total back-to-school spending across categories reveals broader consumer trends shaping the 2025 season.

National overview: total back-to-school expenditures

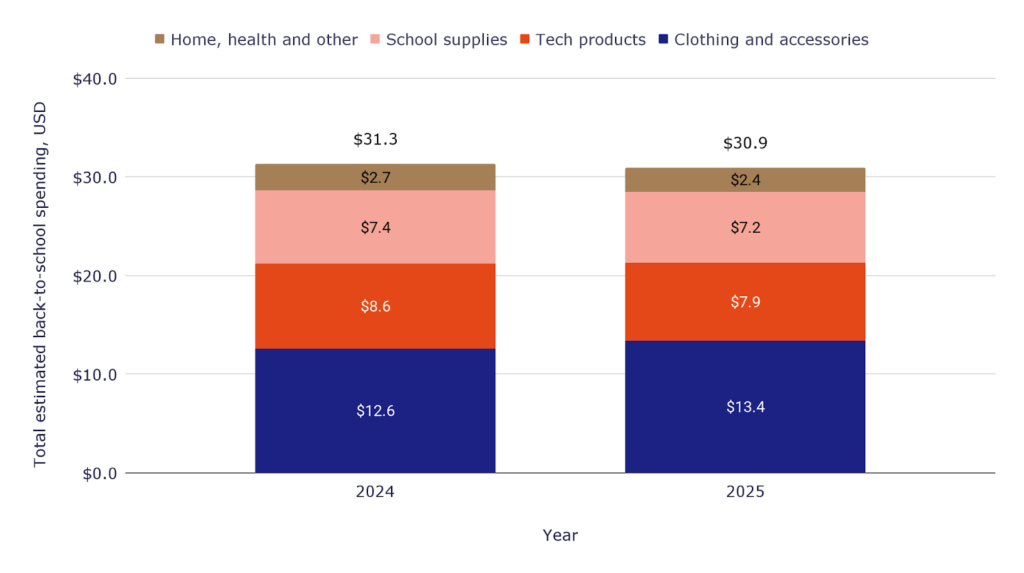

Estimated back-to-school total spending by category in 2024-2025

The chart below presents estimated back-to-school spending by category for 2024 and 2025. It provides insight into how much money is spent on back-to-school essentials overall, from clothing and tech products to school supplies and household items, showing where families are directing most of their budgets.

- Clothing and accessories remain the top category, increasing from $12.6 billion in 2024 to $13.4 billion in 2025.

- Spending on tech products declines from $8.6 billion to $7.9 billion, as families scale back on electronics upgrades.

- School supplies and home, health, and other items also dip slightly to $7.2 billion and $2.4 billion, contributing to a small drop in total back-to-school spending to $30.9 billion.

How much money is spent on back-to-school shopping by category

What is the total back-to-school spending in the U.S.?

- The total U.S. spending on back-to-school in 2025 is $30.9 billion.

The data show that while total back-to-school spending is expected to ease slightly in 2025, families continue to prioritize core needs like clothing and supplies. The decline in tech-related purchases may signal that many households have already invested in digital learning tools in previous years. Overall, the back-to-school spending 2025 outlook points to stable but cautious consumer behavior, reflecting both budget awareness and a focus on essential categories.

After examining how families distribute their back-to-school budgets across categories, it’s clear that rising prices for individual school supplies are a key factor driving overall spending trends.

How back-to-school spending has changed over time

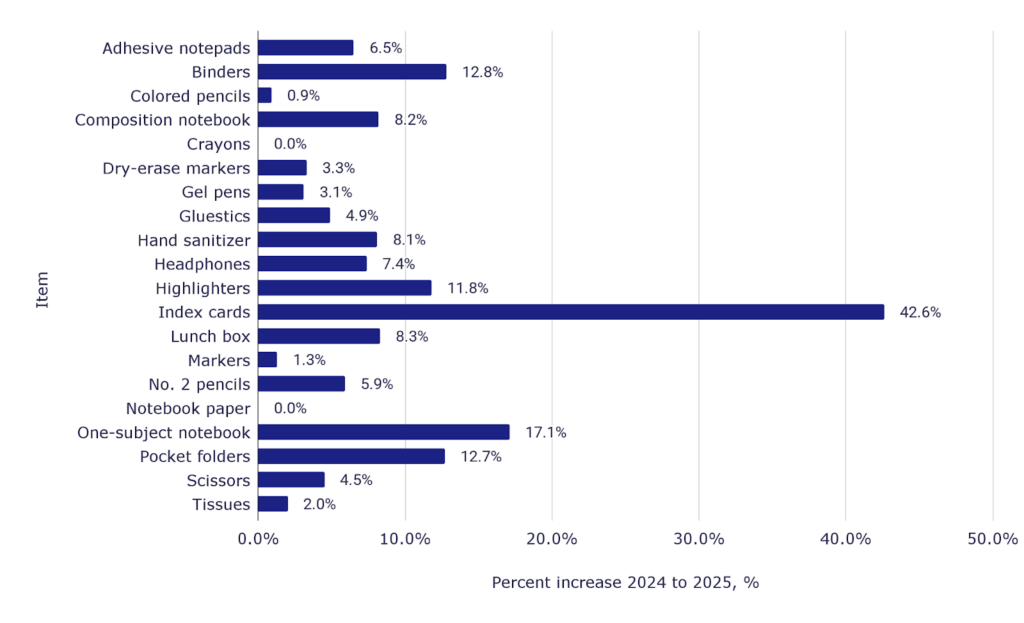

Back-to-school trends: rising school supplies costs in 2025

The chart below shows the price increase for common school supplies from 2024 to 2025, reflecting one of the major back-to-school trends this year. These figures demonstrate how even small item-level price hikes add up, contributing to the broader rise in total back-to-school spending.

- The average cost of school supplies increased by 7.3% year over year, with several essentials showing double-digit price jumps.

- Index cards saw the largest price surge at 42.6%, followed by one-subject notebooks (+17.1%) and binders (+12.8%).

- Even everyday items like highlighters (+11.8%) and pocket folders (+12.7%) contributed noticeably to higher back-to-school spending growth.

School supplies cost increase and back-to-school spending growth

| Item | Price 2024, USD | Price 2025, USD | Percent increase, % |

| Adhesive notepads | $3.69 | $3.93 | 6.5% |

| Binders | $12.18 | $13.74 | 12.8% |

| Colored pencils | $2.12 | $2.14 | 0.9% |

| Composition notebook | $5.86 | $6.34 | 8.2% |

| Crayons | $1.30 | $1.30 | 0.0% |

| Dry-erase markers | $7.34 | $7.58 | 3.3% |

| Gel pens | $12.18 | $12.56 | 3.1% |

| Gluestics | $5.76 | $6.04 | 4.9% |

| Hand sanitizer | $4.20 | $4.54 | 8.1% |

| Headphones | $21.38 | $22.97 | 7.4% |

| Highlighters | $3.56 | $3.98 | 11.8% |

| Index cards | $1.62 | $2.31 | 42.6% |

| Lunch box | $13.97 | $15.13 | 8.3% |

| Markers | $3.02 | $3.06 | 1.3% |

| No. 2 pencils | $11.56 | $12.24 | 5.9% |

| Notebook paper | $2.91 | $2.91 | 0.0% |

| One-subject notebook | $4.68 | $5.48 | 17.1% |

| Pocket folders | $7.88 | $8.88 | 12.7% |

| Scissors | $3.31 | $3.46 | 4.5% |

| Tissues | $13.84 | $14.12 | 2.0% |

| Total | $142.36 | $152.71 | 7.3% |

The data highlight that inflation in classroom essentials remains a strong driver of back-to-school spending growth, even as overall budgets plateau. Parents face higher costs across nearly all supply categories, with steep increases in basic stationery and paper products. This sustained upward pressure on prices suggests that 2025’s back-to-school trends will continue to be shaped by affordability concerns and strategic shopping choices among families.

Beyond classroom supplies, another major contributor to back-to-school spending growth in 2025 is the rising cost of daily school meals and packed lunches.

Rising cost of school meals: a growing part of back-to-school trends

The chart below shows how the prices of common lunchbox and cafeteria items have changed between 2024 and 2025. It highlights one of the most significant back-to-school trends: the steady increase in food prices, which directly impacts parents’ weekly and yearly school meal budgets.

- The total weekly cost of school meals rose from $84.33 in 2024 to $88.85 in 2025, marking a 5.4% increase.

- The cost of fruit saw some of the largest jumps: green grapes rose 34.8%, and strawberries increased 13.0% year over year.

- Over the full school year, meal expenses climbed from $3,035.88 to $3,198.60, reflecting increased household spending constraints.

How food price inflation drives back-to-school spending growth in 2025

| Item | Price 2024, USD | Price 2025, USD | Percent increase, % |

| 1 lb. American cheese | $7.05 | $7.50 | 6.4% |

| 1 lb. bananas | $0.60 | $0.63 | 5.0% |

| 1 lb. deli ham | $12.58 | $12.61 | 0.2% |

| 1 lb. deli turkey | $14.16 | $14.26 | 0.7% |

| 1 lb. green grapes | $2.24 | $3.02 | 34.8% |

| 1 lb. oranges | $3.98 | $4.32 | 8.5% |

| 12 oz. blueberries | $3.11 | $3.34 | 7.4% |

| 16 oz. strawberries | $3.08 | $3.48 | 13.0% |

| Bag of mini pretzels | $3.46 | $3.73 | 7.8% |

| Bag of potato chips | $2.72 | $2.83 | 4.0% |

| Box of graham cookies | $3.74 | $4.18 | 11.8% |

| Individually packaged raisins | $2.63 | $2.71 | 4.2% |

| Loaf of wheat bread | $3.32 | $3.35 | 0.9% |

| Pack of apple juice boxes | $3.50 | $4.29 | 22.6% |

| Pack of apple sauce cups | $2.66 | $2.74 | 3.0% |

| Pack of Gatorade | $7.37 | $7.44 | 1.0% |

| A package of chocolate chip cookies | $3.47 | $3.57 | 2.9% |

| A package of sandwich cookies | $4.66 | $4.82 | 3.4% |

| Total per week | $84.33 | $88.85 | 5.4% |

| Total for school year | $3,035.88 | $3,198.60 | 5.4% |

The data underscore that rising food prices are now a meaningful driver of total back-to-school spending growth, compounding the impact of higher supply costs. Even small increases in snacks, produce, and beverages add up over an entire school year, pushing meal-related expenses to record levels. As a result, the back-to-school trends of 2025 point toward more careful meal planning, cost-saving strategies, and increased awareness of household food budgets among parents.

Conclusions

By 2025, U.S. back-to-school spending is expected to reach $30.9 billion, reflecting a cautious but resilient consumer landscape. Families are prioritizing essential purchases as inflation and economic uncertainty reshape shopping behavior nationwide.

While average household spending ($886) remains high, the steady decline since 2022 underscores a structural adjustment in family budgets. Rising supply and meal costs, up 7.3% and 5.4% respectively, continue to erode purchasing power, prompting parents to allocate more carefully toward necessities.

The narrowing gap between low- and high-income households suggests a more uniform cost burden across income groups, driven by shared inflationary pressures rather than increased affordability.

Overall, the 2025 back-to-school season highlights a shift toward financial restraint and essentials-first spending, signaling that U.S. households are adapting to sustained price growth through selective, value-driven purchasing decisions.

Sources

- “Back-to-school shopping expected to reach almost $900 per household in 2025.” Empower, https://www.empower.com/the-currency/money/back-to-school-research. Accessed 11 November 2025.

- LLP, Vice. “2025 Deloitte Back-to-School Survey.” Deloitte, https://www.deloitte.com/us/en/insights/industry/retail-distribution/back-to-school-survey.html. Accessed 11 November 2025.

- West, Rachel. “Eight Ways Trump Is Making the Back-to-School Season More Expensive.” The Century Foundation, 13 Aug. 2025, https://tcf.org/content/commentary/eight-ways-trump-is-making-the-back-to-school-season-more-expensive/. Accessed 11 November 2025.